ATTORNEY SERVICES

FINANCIAL TRANSITIONS

GOVERNMENT BENEFIT PRESERVATION

LIEN RESOLUTION

MARKET-BASED STRUCTURED SETTLEMENTS

MASS TORT SETTLEMENT RESOLUTION

MEDICARE SET-ASIDES

NON-QUALIFIED STRUCTURED SETTLEMENTS

PROBATE COORDINATION

QUALIFIED SETTLEMENT FUNDS

TRUST SERVICES

STRUCTURED SETTLEMENT ANNUITIES

SETTLEMENT PLANNING

Structured Settlement Annuities

What is a Structured Settlement?

A structured settlement annuity (“structured settlement”) allows a claimant to receive all or a portion of a personal injury, wrongful death, or workers’ compensation settlement in a series of income tax-free periodic payments.

Structured settlements may also be used in non-physical injury settlements so that our clients may receive tax-deferred income instead of receiving an immediate and fully taxable lump sum settlement payment.

A Sage settlement consultant can advise you of your different structured settlement annuity options, which include:

- Fixed-Indexed Annuities

- Single Premium Immediate Annuities

- Deferred Income Annuities

- Multiple-Year Guarantee Agreements.

How Does a Structured Settlement Work?

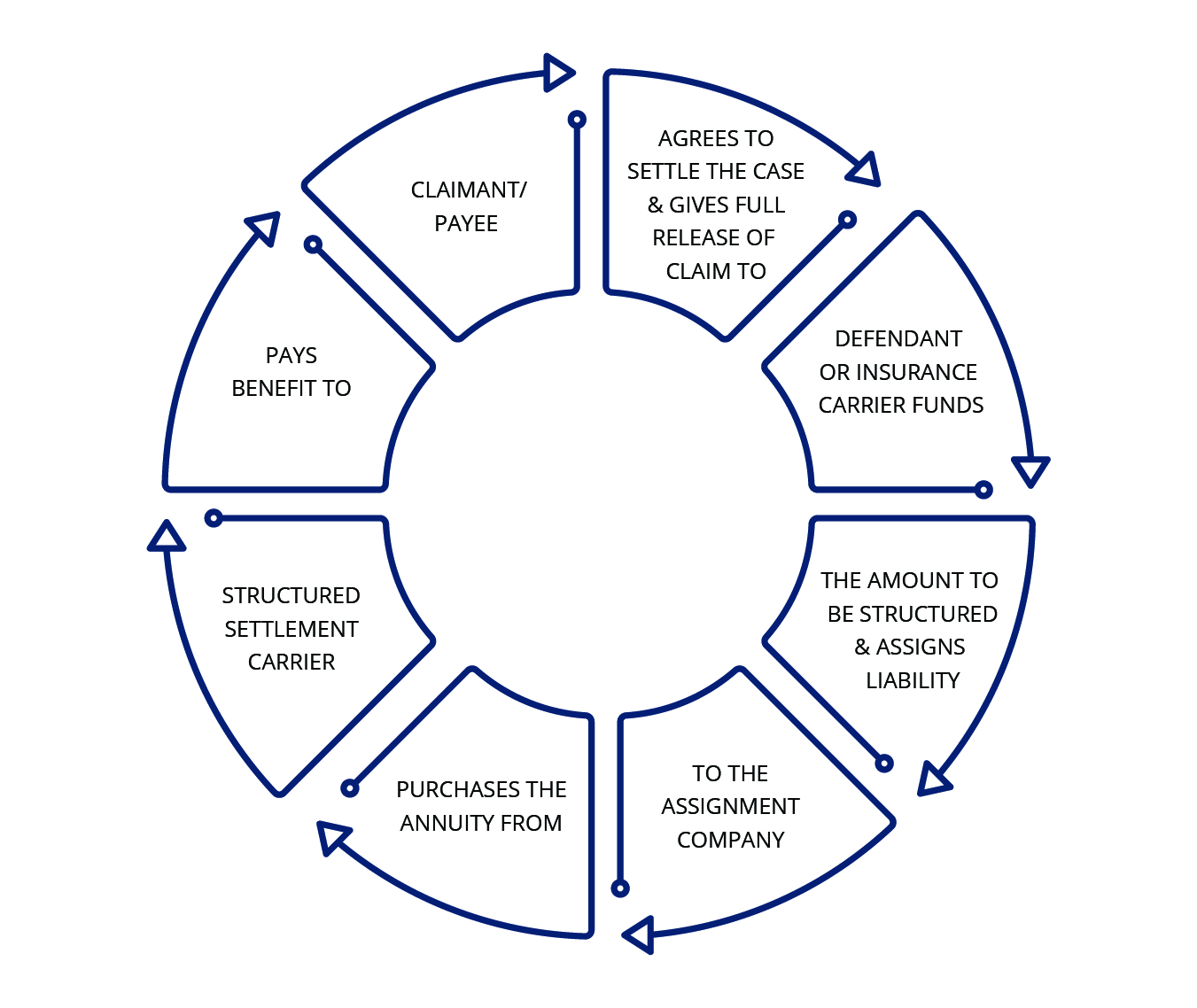

The decision to utilize a structured settlement must be made before finalizing the settlement agreement. Once both parties have agreed to the details of the structured settlement, the claimant releases the defendant (or insurer) from liability.

The defendant or insurer then pays the settlement funds to a third-party assignment company, which assumes liability and purchases an annuity from a structured settlement carrier. The carrier then makes a series of periodic payments based on a previously agreed upon timeline and amount.

Structured settlements may be funded with proceeds from settlements of almost any size; in fact, many structured settlement providers will structure amounts as low as $10,000. The choice is ultimately the claimant’s, and many find that a structured settlement is much more beneficial than a lump sum cash payment.

Benefits of a Structured Settlement

100% income-tax-free for physical injury and wrongful death cases:

Payments (including growth) for physical injury and wrongful death cases are free from state and federal income tax under Section 104(a) of the Internal Revenue Code.- 100% income tax-deferred for non-physical injury cases:

Payments (including growth) for non-physical injury cases are tax-deferred.

- Guaranteed payments1:

The schedule of payments is determined on the front end of the transaction, resulting in a steady source of safe, reliable income for the claimant.

Guaranteed rate of return:

- No overhead fees or expenses:

The lack of overhead fees combined with the preferential tax treatment allow structured settlements to remain competitive with traditional investments.

With a locked-in rate of return, injured claimants can rest assured that market volatility will not affect their structured settlement payments.

Market-Based Structured Settlements

There are additional investment options available to claimants who may not be interested in a structured settlement annuity. To learn more, visit our Market-Based Structured Settlements page.

1Guarantees are subject to the claims-paying abilities of the issuing insurance company.